On corporate governance.....or the lack of it

A headline in the media today caught my eye - "New Zealand has lost more ground in a world ranking of economic competitiveness, with corporate governance and research and development cited as two of the major weaknesses."

The full text of the article is here - and it makes for sobering reading

The status of Research & Development in NZ is unfortunately a moving feast, and depends as much on appetite as on funding.

Corporate governance is - or should be - non-negotiable, and this is clearly NOT the case in New Zealand.

I've been off the air for a few weeks taking on a new study course from Waikato University on Corporate Governance and Leadership, so I've been donkey-deep in text books, articles, journals, and assignments. The course content is excellent, and the NZ Institute of Directors is to be commended on the initiative, and while this is the first serving of the course, the subject matter, the academic staff, and the strategy behind the initiative are all excellent.

At the end of the course later this year, I'm looking to construct a 3-step module for presenting the subject of Corporate Governance to Small-Medium Enterprises in New Zealand.

So why would I bother going to all this trouble for something that doesn't seem to figure too highly in the commercial priorities?

Well, I guess because I've seen the competition overseas first-hand, and I can confirm that the place of corporate governance in the strategic planning of our international competitors is growing ever stronger and more significant. Companies overseas are judged on many aspects by shareholders, analysts, the media, and the wider community - but corporate governance is now becoming a major factor in profiling commercial entities, and those regarded as having poor governance practices are being marked down by stakeholders.

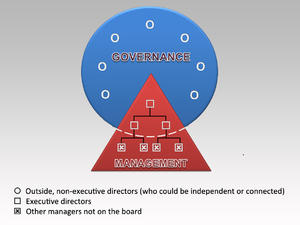

By corporate governance, I don't mean the box-ticking exercises indulged in by Enron and other failed entities - I mean the meaningful daily attention paid by every employee, manager, and leader of an organisation with regard to the system of rules, practices and processes by which a company is directed and controlled.

The Corporate Law Economic Reform Programme (CLERP) in Australia is now firmly embedded in everyday commercial life - and given the fact that individuals entering industry and commerce in Australia anytime after 2005 have no knowledge of any other commercial environment - it's hardly surprising that NZ is way behind Australia in this league table.

And it's not difficult to cite examples of downright scandalous governance practices in NZ. Take, for example, the Hulijch shambles when the CEO allegedly dropped some of his own money into the Kiwisaver investment funds to make up for some short-term losses.

A victim-less crime? Not quite - as all subsequent investors were misled as to the true performance of the funds in question. To make matters worse, two of the Non-Executive Directors (NEDs), namely Don Brash and John Banks, shrugged their proverbial shoulders and disavowed all knowledge of what had happened, and claimed that it wasn't reasonable to expect a Non-Executive Director to be aware of such issues.

Well, guys, sorry but that's EXACTLY what Non-executive Directors are paid for as an essential part of their brief of behalf of shareholders. Oversight of the CEO is fundamental to sound corporate governance and holding the Chief Executive accountable to the Board is precisely where the NEDs adds value.

For Messrs Banks and Brash to walk away unscathed is a travesty, and adds to the already growing perception that New Zealand doesn't give two hoots about corporate governance, while the rest of the world is rapidly tidying up slack practices and getting rid of the dead-wood NEDs who regard board appointments as a mere stipend with no responsibility, little work load, and easy money earned over a few sherries and a thundering good lunch.

If NZ is to regain any respect and standing in the international community, we need to make company directors more accountable, better qualified, and more competent in order to tackle the challenges of corporate governance.

Slainthe

The Laird