There is a spectre haunting New Zealand..........................

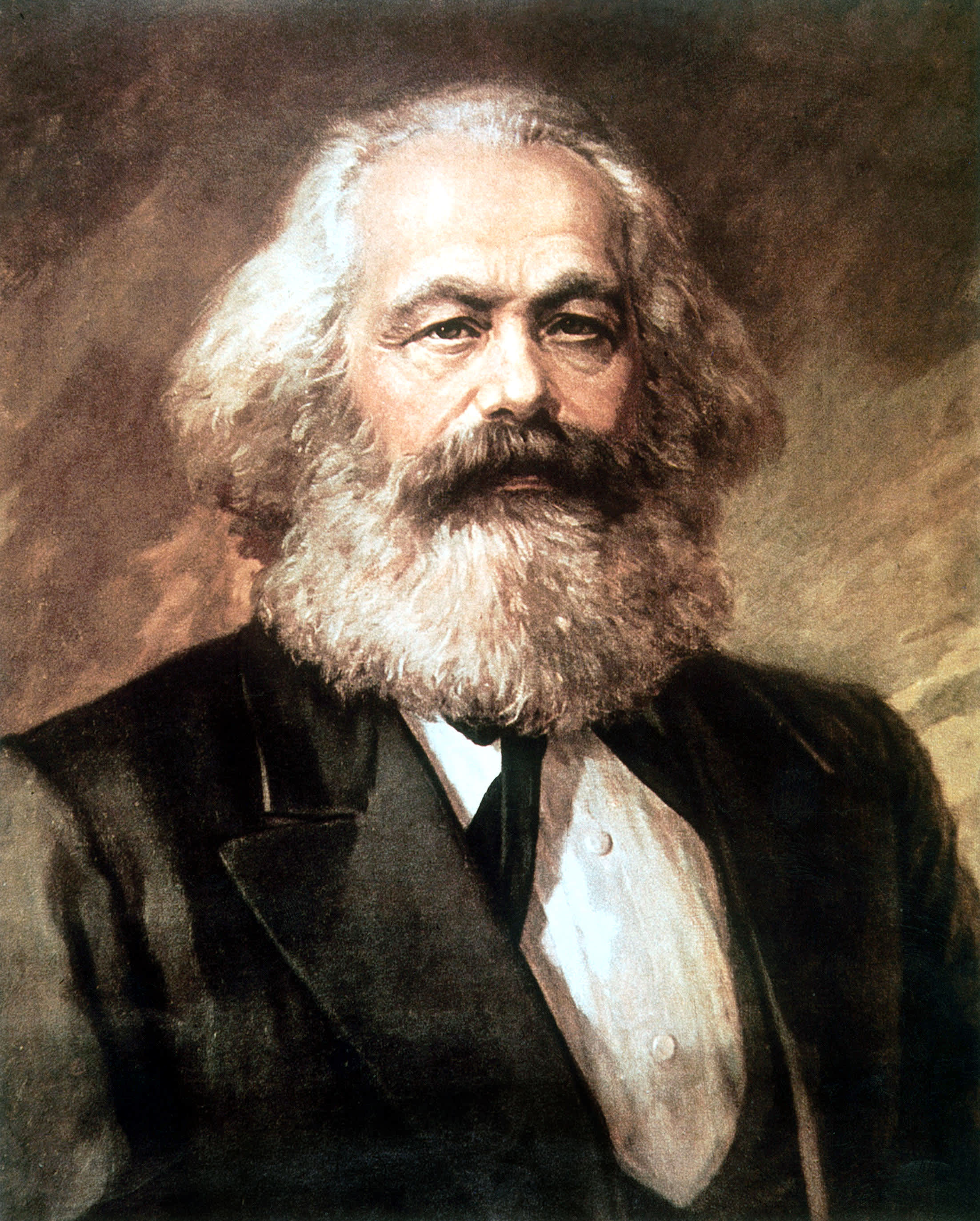

For those who are students of political history, you may recognise a paraphrase of the opening words of the Communist Manifesto.

In 1848, Marx was writing about Communism being the spectre haunting Europe; in 2012, the Laird is referring to the spectre of underinsurance haunting New Zealand.

Just as Communism was identified as a threat to the ruling classes of 19th century Europe, underinsurance is a present-day threat to the well-being and security of all New Zealanders.

Run a Google search on underinsurance - and specifically on life insurance - and you'll come up with some interesting items - some local, some from the U.S.A. and Australia. While the material isn't exactly hot off the presses, it's relevant and applicable all the same.

Specifically, this report from the University of Canberra was published in early 2010, but there's every reason to suspect that the situation in Australia prevails now as it did then, and that New Zealand is in a similar position.

The reports, papers, and articles cite various reasons and causes - ranging from a "she'll be right" attitude from consumers in both countries, to expressed confusion regarding product complexity and cost.

It's also worth noting that in Australia, every self-respecting super fund offers the permitted range of risk benefits - life cover, TPD, and salary continuance - as integrated benefits at nominal cost. Group underwriting applies and in many instances, we're talking about as little as A$1 per week in the absence of anti-selection.

The take-up rate is pretty good as you might expect - which is positive. However, the downside is that Super Scheme members believe that the cover they have in their super scheme provides adequate financial protection for dependents - which it most certainly does not.

Risk benefits are uniform and based on 1 or 2 units of cover, usually 1 x salary - well below the level required to look after the financial well-being of dependents. Remember, contributing to a Super Fund in Australia is compulsory (sensible), and that the risk benefits are funded from the contribution. Lapse rates are non-existent, and the 'safety-net' protection intended by the legislation is in place across a large percentage of the Australian work force. Of course, it was/is expected that more customised financial protection would be forthcoming outside the superannuation structure, but, as is reported, the levels of cover remain woefully inadequate.

The Laird's ex-Boss in AIG days, Maurice (Hank) Greenberg regarded life insurance as a civilising influence, and reflective of a society which recognises the need for individual and personal financial responsibility.

So when AIG opened for business in a new territory, simple basic personal accident contracts were marketed in order to set a solid business base for the territorial operation, with more complex products introduced as the company's presence grew and matured. It has to be said that in this respect AIG was highly successful, particularly in Asia.

Various initiatives during the Laird's stint in Melbourne sought to publicise the underinsurance issue - most notably IFSA (now the Financial Services Council - Australia as distinct from the NZ body of the same name) mounted a campaign to bring the scourge of underinsurance to the attention of a wider audience. Paul Clitheroe - well known on Australian television for his financial and investment programmes, and who is no stranger to NZ shores - also embarked on a financial literacy campaign involving government and private enterprise. However, it seems that both initiatives have had but a nominal effect on the problem.

Nevertheless, whatever the outcome of such initiatives elsewhere, it is incumbent upon every New Zealand Financial Adviser to install and maintain appropriate levels of financial protection for every client. When was the last time you conducted a systematic review of clients' protection levels, and are you 100% certain that 100% of clients are 100% covered?

The Laird understands that our own Financial Services Council is soon to be launching an awareness campaign on the underinsurance spectre - an initiative which has full support from this quarter, and should be enthusiastically embraced by Advisers of all descriptions and their various representative bodies.

Marx's call to action was for the workers of the world to unite. The Laird exhorts all Advisers to unite and get behind the FSC campaign whenever it starts, review every clients cover at every opportunity, and banish the spectre of underinsurance from New Zealand forever.

Cheers

The Laird of Albany